First, do this: go online and search “Balcones whiskey and its investors.”

The Balcones lesson is this: once you take investor money, your company changes. It is no longer purely a vehicle for your art. Investor money puts you on a one-way trip to a “liquidity event,” or a way to pay your investors back. Sure, artfully cutting heads and tails still matters. But your investors’ interest matters just as much. Welcome to the Shark Tank.

Get it right and more people will enjoy your products, and you and your shareholders get richer. Get it wrong, and you could be facing company failure.

So how do you successfully swim with financial sharks? Below is a list of a dozen secrets, compiled from many experienced hands. The first six are the different types of investor capital you can raise—and it is the longest menu of financing choices ever available in business history. The last six are about finding and retaining the right type of money.

The 6 Types of Funding Now Available for Craft Distilling-Related Companies

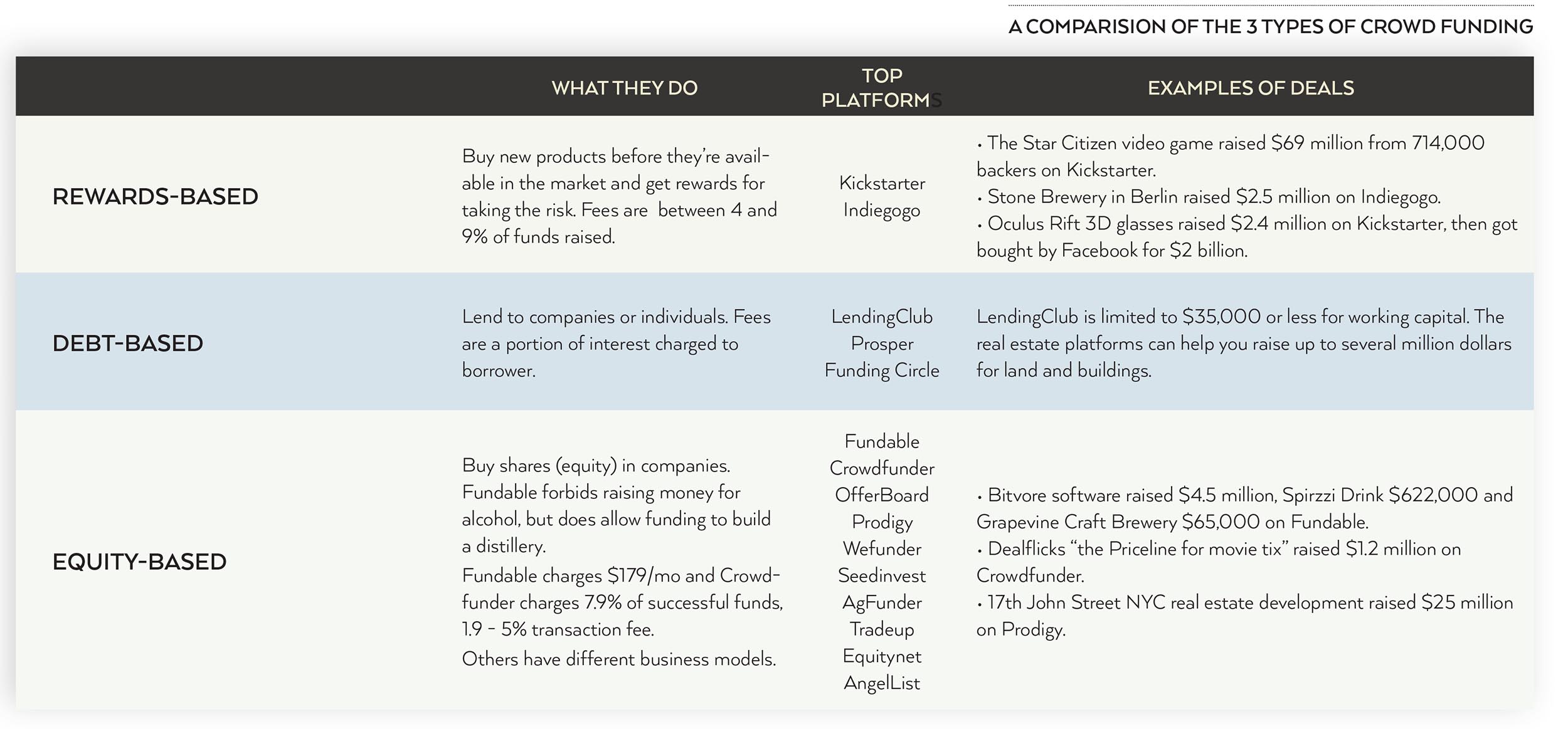

The first three fund types are “crowdfunding”—rewards-based, debt-based, and equity-based—three new ways to borrow money online, sell shares or sell something that does not yet exist. Crowdfunding is new to America; made possible by the passing of the 2012 JOBS Act.

Which of the 6 types of investor capital are right for craft spirits enterprises? These summaries might help you decide.

Rewards-Based Crowdfunding

With rewards-based platforms such as Indiegogo and Kickstarter, you can pre-sell product that you have yet to create, and reach a large international audience. Over $3 billion went into rewards campaigns in 2014. The best part is the money you raise is not debt or equity, it’s revenue. Word to the wise, though. Crowdfunding campaigns require significant preparation. When you launch your 90-day campaign (a common time limit), you must set a campaign fundraising “goal.” Recent history shows that you will nearly always hit your goal if your campaign hits 50% of goal within the campaign’s first 15 days. That means, launch fast your online campaign with a strong product story, price your “rewards” right, shoot a great video or two, build a large email list of potential participants and social media friends on Facebook, Twitter, LinkedIn, Snapchat, Tumblr, and promote like heck. Rewards-based campaign success has often led companies to graduate to do a much-larger equity-based campaign.

Debt-Based Crowdfunding

If you need less than $35,000 for working capital or $5 million or even more for a real estate-based project, debt-based campaigns may be for you. Crowdfunded loans are no different than loans from your bank. They feature rather high interest rates, and you must pay them back on time or face the consequences.

Equity-Based Crowdfunding

Equity-based crowdfunding is the fastest-growing of the three, and represented $3 billion in 2014. That’s because the JOBS Act law is evolving in 2015 to expand online investment limits, and as a result, equity crowdfunding is expected to represent a significant competitor to angel and venture capital (VC) investing (the angel and VC markets are each 10 times larger than equity crowdfunding is today). Successful equity campaigns involve as much or more preparation as for a rewards-based campaign, but the campaign dollar figures are typically larger. Statistics for 2014 show that angel investors are starting to gravitate toward equity crowdfunding campaigns because the equity platforms offer disclosure levels that are more uniform and in-depth than many angel investors accustomed to seeing.

Angel Equity Investment

“Angels” got that name from investors who funded Broadway shows. Now “accredited” angel investors, who have annual income over $200,000 or minimum net worth of $1 million, invest a few thousand to a few million in every type of enterprise, and did it to the tune of an estimated $30 billion in 2014, a little less than venture capital. Many angels have joined formal networks such as Angel.co, or are members of the Angel Capital Association (www.angelcapitalassociation.org). Angels most often invest as loans that are convertible into equity (“convertible debt”). Angels represent the largest single type of investor in beverage, food and alcohol-related investments, and will likely continue to be the top source of capital for craft distilling-related ventures.

Venture Capital Equity Investment

VCs have been called everything from “vultures” to “vulgar.” Regardless the handle, member firms of the National Venture Capital Association have created more shareholder value than any investor group in the history of the world, and are behind companies such as Apple, Microsoft, Google, Facebook, Yahoo!, Continental Cablevision, AdvancePCS, Amazon and Uber. These firms often lose money on 75% of their investments, but offset losses with home-run deals. For example, Sequoia Capital’s $60 million equity investment in What’sApp turned into $19 billion when Facebook bought the company in 2014, a 31,700% return. VCs invest both as direct equity and convertible debt. VCs invested $33 billion in 3,480 deals in 2013. In the first half of 2014, VCs invested $1.1 billion in food and beverage deals, a segment which is attracting more activity. For example, Benchmark Capital recently backed Potbelly Sandwich Shops, and Google Ventures put $25 million into Blue Bottle Coffee. One firm, the Food-X arm of SOS Ventures puts $50,000 in multiple food and beverage ventures for an 8% equity stake in each (that’s a “pre-money valuation” of $575,000, “post-money valuation” of $625,000. This concept is described below.). While $50,000 may seem small, Food-X also brings values to the firms by providing connections to distribution, packaging, and other helpful resources.

Bank/Debt Funding

For centuries, banks have been the original capitalists, the middleman between depositors who earn interest and borrowers who pay interest to use the money. SBA, or Small Business Administration loans, are also available to distillers. SBA loans allow the entrepreneur to raise money without giving up equity. With credit card, car and student loan debt at $3.3 trillion, and total consumer bank credit at about $12 trillion, banks and credit cards are by far the most readily available source of financing for the craft distilling industry.

Understand Two Critical Concepts: Pre-Money and Post-Money Valuation

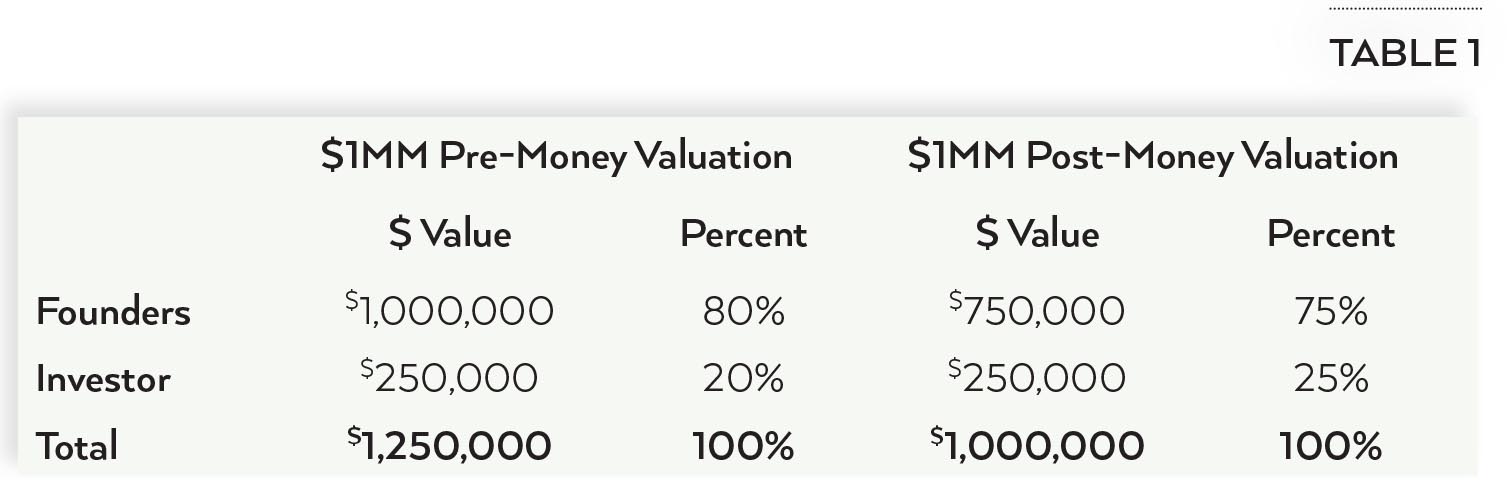

Here’s a simple example of the difference in ownership that results from investing $250,000 in a $1,000,000 “pre-money” deal versus a $1,000,000 “post-money” valuation. (See Table 1 below).

While ownership percentages differ depending on whether the investment price is pre- or post-money, other factors can also alter your cap table. Examples include equity purchase discounts, ability to include interest in conversion, company purchase price (otherwise called “internal rate of return” or IRR), refinancing terms, periodic operating results and employee stock option allocations. Investopedia.com is a good source for more discussion. A good lawyer can explain all these terms to you.

Hire a Lawyer Who Knows Fundraising Law—Not Your Regular Contract Lawyer

Here is an easy two-question test to see if your lawyer can deal with your capital-raising needs;

1) Do you have any experience in structuring crowdfunding, angel investing or venture capital contracts? (Correct answer: yes.)

2) What is the pre-money valuation of a $100,000 investment in a company with a $1,000,000 post-money valuation? (Correct answer: $900,000, that’s because $100,000 + $900,000 = $1,000,000.) A wrong answer to either means this: find someone else.

Know Your Capitalization Table—Ignore Your Cap Table at Your Own Peril

What is a capitalization table? It’s a table showing who owns what percent of your company. There are lots of tricks that investors can play with terms and conditions. Warning: Cap table tricks are among the top ways that founders lose their companies to investors. It’s like marriage. Get a good lawyer and pay attention to the details of who owns what, and the terms of each piece of the investment. For more on this complex topic, go to Investopedia.com’s “capitalization table” discussion.

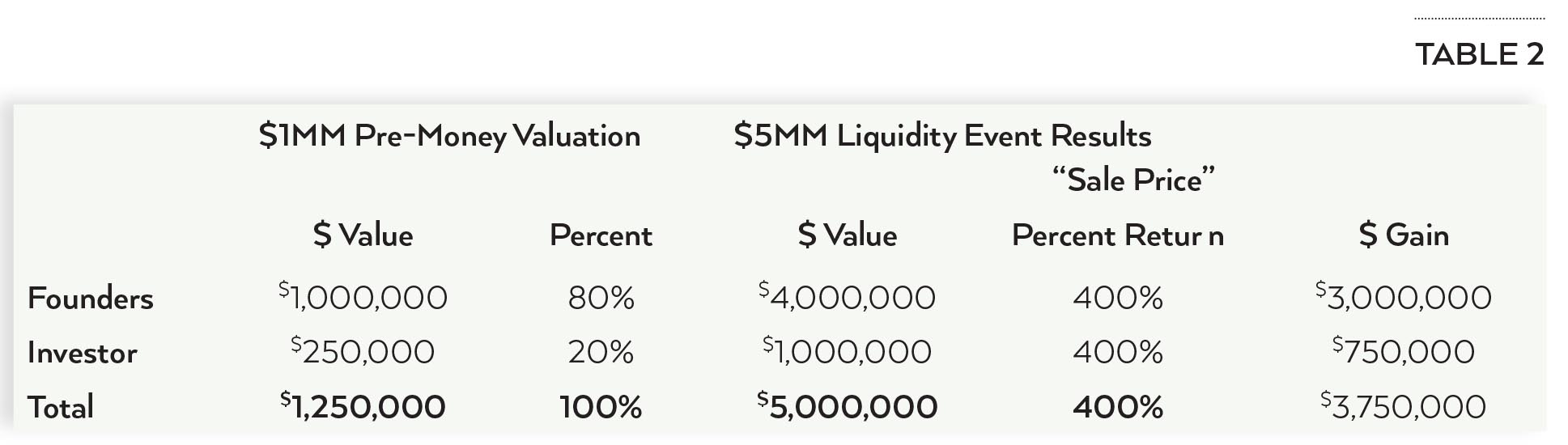

Know What Happens In a Liquidity Event, When Convertible Debt Converts to Equity

Convertible debt (loans that can convert into shares) is best for companies that have not yet set a valuation. Early-stage investors like convertibles because they earn interest until you decide on a conversion valuation. The downside of convertible is that they can get complicated, so you need a lawyer to draft the agreements. Here’s a convertible example: An investor gave you a $250,000 convertible loan with a $1 million pre-money valuation, then you sold your company for $5 million.

(See Table 2 below).

Investor Negotiation Principle #1: Respect Your Investor’s Perspective (It’s Different Than Yours)

What do you want from investors? You want their money, encouragement and some time and latitude to do your best. What do investors want? They want your best efforts, reliability, transparency, availability, and respect for their liquidity timetable (do they want their money back in 5 years or 1 year?). Be ready to give investors what they want before you take their money.

Whitehead’s Rule: With Disclosure, All Things are Possible

The data doesn’t lie. Investors support companies who disclose the most about themselves, because disclosure signals confidence in future performance. The proof: A 15-year study of Russell 1,000 large-cap companies who made the famous “100 Best Corporate Citizens List” that ranks companies by how much they reveal about themselves (on key topics such as investor relations, environment, HR, human rights, community involvement, etc.), showed that the 100 best companies were the world’s best-performing stocks, in good times and bad. The same goes for smaller investments in craft distillery-related enterprises. Disclosure is your best investor acquisition and retention weapon. Besides, in the Internet age, if there’s information worth finding out, investors will find it out anyway. Make sure you tell them first.

Now is the best time in human history to raise investment capital, with more options and availability of funds than ever before (and more complexity). But just like distilling, raising money is an adult undertaking. Children, don’t try this at home.